Xrp

Opened last October by ex-Valkyrie founder and CEO Steven McClurg, Canary quickly filed back-to-back applications for four crypto-related exchange-traded funds (ETF).

Ripple’s CEO calls for a U.S. strategic bitcoin reserve that’s includes more than one token.

CME’s denial of XRP futures contradicts the optimism seen earlier this month, as technicals point to weakening of the uptrend.

A screenshot of a beta page for XRP (XRP) and Solana (SOL) futures contracts was posted on X earlier on Wednesday.

Trader demand for Solana’s SOL rose as Donald Trump’s so-termed official token was issued on the network.

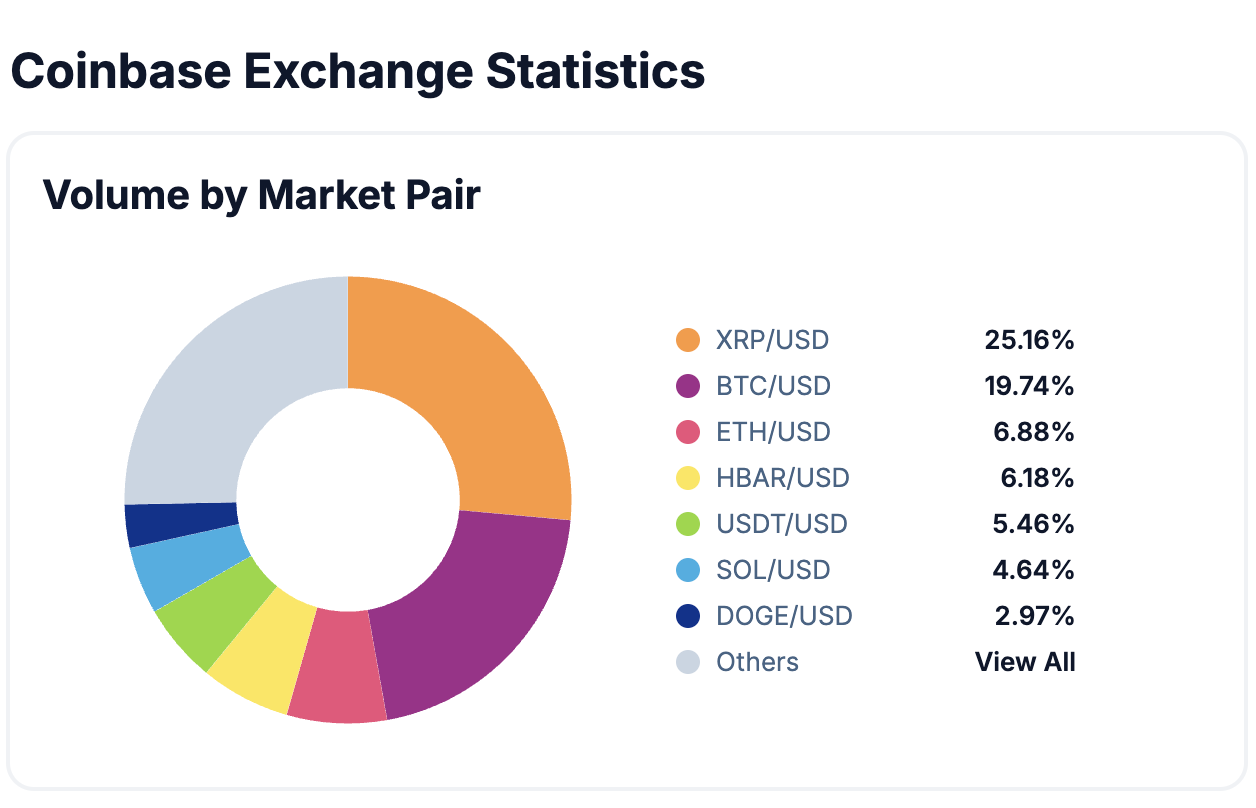

XRP leads volume trends on Coinbase, with BTC and ETH taking second and third places. On Binance, bitcoin is still the most in demand.

XRP’s price rise is accompanied by record perpetual futures open interest and surge in trading volumes.

Growing speculation of a potential spot XRP ETF is one of the factors driving the surge, one crypto analyst said.

A “descending triangle” pattern in technical analysis points to bigger gains for the top-performing major token.

“We think, especially with the administration change, the approvals of those filings will accelerate,” Ripple president Monica Long said.