Trade

Dogecoin shed 3% while bitcoin (BTC) and ether (ETH) remained flat in the past 24 hours as tariff concerns gradually subsided among traders, though fears of a U.S. recession increased in betting markets. “Prominent financial figures have started to …

The complex pipes that keep derivatives trades moving are about to get a major efficiency boost in DeFi, according to Crypto Valley Exchange. Crypto Valley Exchange’s “smart clearing” protocol will lower the capital requirements for …

Activity in PowerTrade’s options market for alternative cryptocurrencies (altcoins) picked pace this week as heightened market volatility prompted traders to seek derivatives for hedging and speculative opportunities. Trading volume in XRP options …

Bitcoin (BTC) dipped to nearly $75,000 early Wednesday, before slightly recovering, as Trump’s sweeping küresel tariffs went into effect on Wednesday. Ether (ETH) dived 10%, leading losses among major tokens, with xrp (XRP), dogecoin (DOGE), BNB Chain …

China eased its grip on the yuan (CNY) on Tuesday, allowing it to depreciate beyond a key level, likely in response to President Donald Trump’s aggressive tariffs. Crypto analysts anticipate that the yuan’s depreciation could favor bitcoin (BTC …

Bitcoin’s (BTC) recent stability amid Nasdaq turmoil driven by tariffs has generated excitement among market participants regarding the cryptocurrency’s potential as a haven asset. Still, the bulls might want to keep an eye on the bond market where …

The kickstart of heavy tariffs under the Trump administration has ushered in a new chapter of uncertainty and opportunity for the crypto market, one that tends to ebb and flow with changes in the küresel economy. Tariffs, by design, increase the cost …

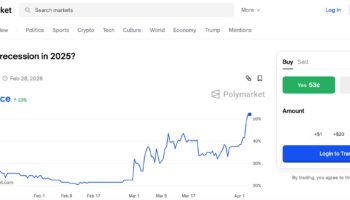

U.S. recession fears are in the air following President Donald Trump’s tariff plan, with prediction platforms Polymarket and Kalshi indicating heightened concerns the economy will take a hit. On Polymarket, a decentralized prediction platform, the …

Higher-than-usual market volatility affected bulls and bears alike as crypto futures racked up $450 million in liquidations in the past 24 hours as U.S. tariffs went into play. President Donald Trump officially levied a 25% tariff on auto imports and …

It’s a risk-off day in Asia as traders look to Beijing’s response to U.S. President Donald Trump’s sweeping reciprocal tariffs on China and other Asian nations. On Wednesday, Trump announced reciprocal tariffs on imports from 180 nations, including …