Price

XRP’s price rise is accompanied by record perpetual futures open interest and surge in trading volumes.

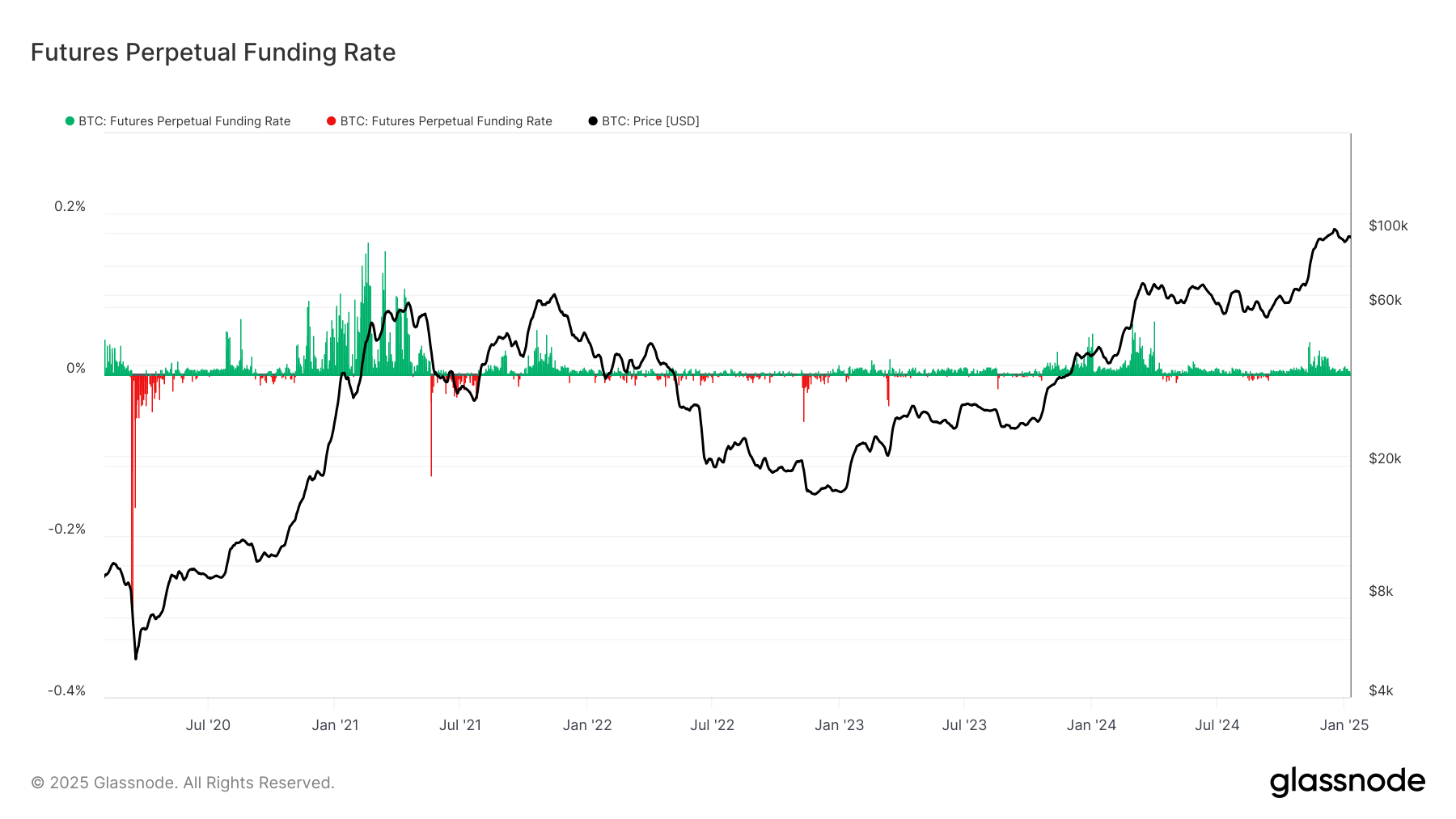

BTC’s latest price action seems to contrast sharply with the uptrend exhaustion observed at record highs above $108K in mid-December.

BTC neared $95,000 in European morning hours Friday after a slump in U.S. hours sent it to near $90,000 late Thursday, down 10% from a weekly high above $120,000.

Glassnode veri shows that the perpetual funding rate went negative for the first time in 2025.

The market depth shows dominance of buy orders at levels away from the going market rate.

A “descending triangle” pattern in technical analysis points to bigger gains for the top-performing major token.

Mining stocks including WULF, BTDR, IREN and HUT dropped over 5%, while BTC holder medical devices firm Semler Scientific plunged 10%.

BTC’s latest price drop might be setting the stage for a major bearish reversal pattern.

Whale transactions and large withdrawals from exchange signal demand for the largest memecoin by market capitalization.

A technical correction and reversal is close to being complete and could trigger a full-blown bullish move, some traders say.