Price

Options pricing on Deribit suggests BTC could swing by nearly $5K following the crypto summit, according to analysis by STS Digital

The ETF saw over $1 billion in outflows last week alongside a surge in trading volumes.

CME gaps — price disparities caused by the exchange’s weekend closure while spot markets trade around the clock — tend to historically act as magnets for bitcoin prices.

Prices have pulled back to the descending trendline from Jan. 16 highs.

XRP, ETH, SOL and ADA price have also surged following Trump’s announcement.

“Historically, CME gaps are filled eventually,” one analyst said.

In a worst case scenario, prices could slide to the $72,000–$74,000 range, one analyst said.

Bitcoin’s stumble begs the question asked during the last bear market: Is there a point at which Michael Saylor would be forced to liquidate part of the company’s near-500,000 BTC stack?

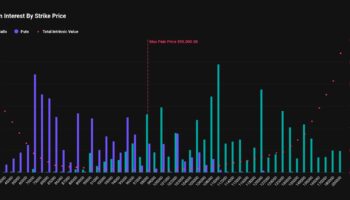

Over $5 billion of notional value is set to expire this Friday on Deribit at 08:00 UTC.

Futures activity hints at an influx of fresh shorts as Monday’s bearish marubozu candle points to more losses ahead.