Level

This is a daily technical analysis by CoinDesk analyst and Chartered Market Technician Omkar Godbole. Bitcoin’s (BTC) bullish advance has encountered a resistance zone above $88,000, marked by crucial levels that could make or break the ongoing …

Bitcoin (BTC) held steady above $88,000 early Tuesday as the Japanese yen crossed the psychological level of 140 against the U.S. dollar, as tariff concerns and risks of a Federal Reserve chairman shuffle in the states broadened the appeal of safe …

Bitcoin (BTC) and major cryptocurrencies fell over 3% as profit-taking followed Tuesday’s rally. Overall crypto market capitalization fell 3.3% in the past 24 hours, with BTC sliding to nearly $83,500 from a high above $84,200 a day earlier. Ether …

Küresel Economic Tensions Impact SHIB The cryptocurrency market experienced significant turbulence as escalating trade tensions between the United States and China sent shockwaves through küresel financial markets. Shiba Inu (SHIB) was not spared from …

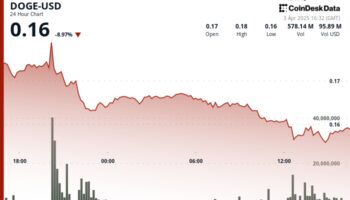

Recent Price Action Shows Signs of Recovery In the last 100 minutes of trading, DOGE has demonstrated a notable recovery pattern, climbing from a local bottom of $0.156 to stabilize around $0.158. The price action shows an apparent V-shaped …

One position worth $126 million was just 4% away from being liquidated.

Fibonacci retracement levels serve as potential areas from which prices resume the primary trend.

Fundstrat’s head of research, Tom Lee, calls for a potential short-term drawdown but remains bullish regarding the end-of-year target.

The market depth shows dominance of buy orders at levels away from the going market rate.

A technical correction and reversal is close to being complete and could trigger a full-blown bullish move, some traders say.