Btc

BTC hits three-month as Nasdaq futures point to continued risk aversion in stocks and the anti-risk Japanese yen strengthens against the U.S. dollar.

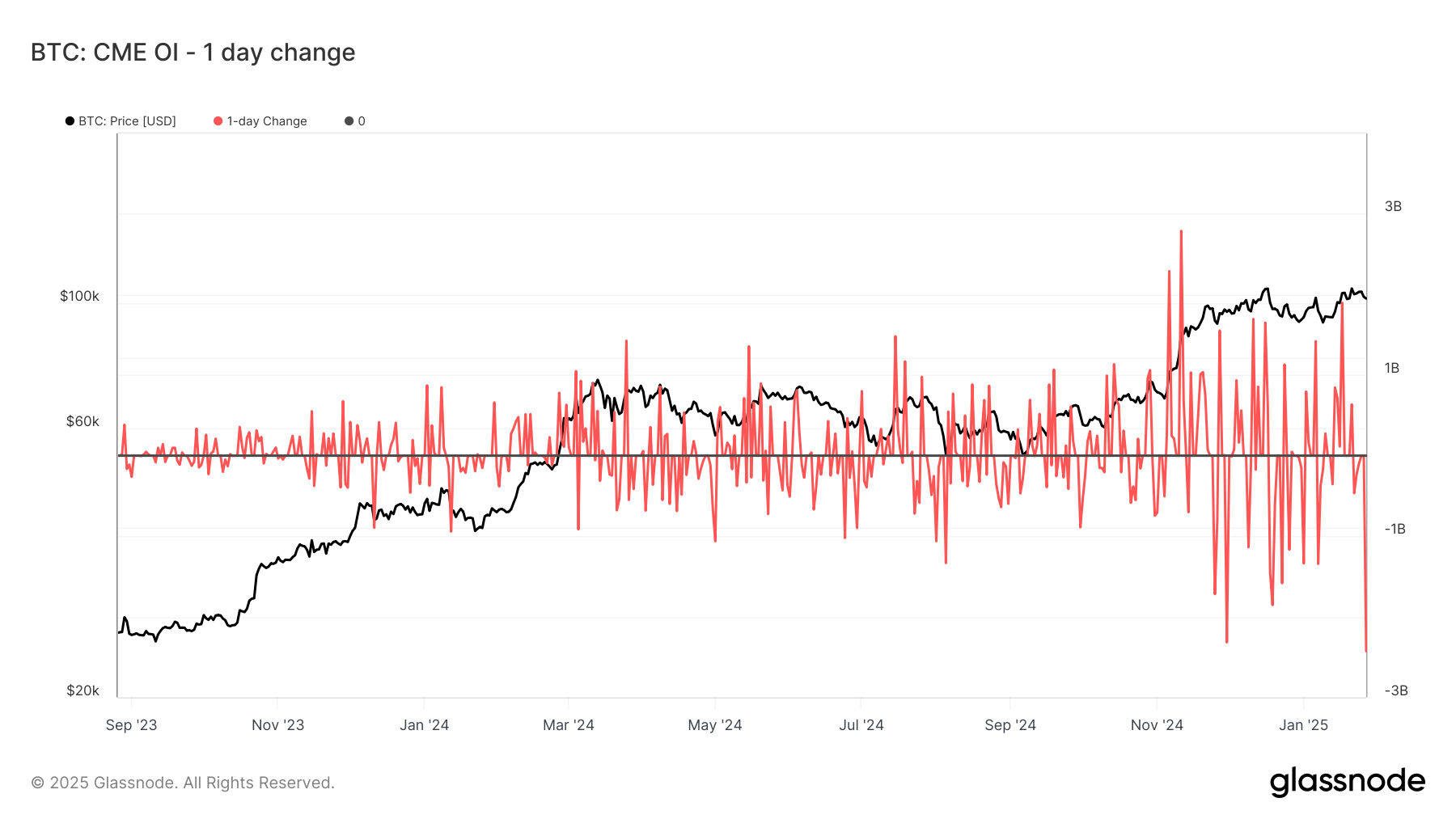

Futures activity hints at an influx of fresh shorts as Monday’s bearish marubozu candle points to more losses ahead.

Bitcoin entered the final stretch of its weekly cycle and could bottom soon, a well-followed trader said.

The ability to earn yield on bitcoin and potentially unleash a new wave of liquidity into the DeFi ecosystem has become a hot topic of late.

The ratio of Binance USDT reserves to user balances also dropped significantly.

BTC takes a breather as Trump’s tariff threat bodes well for gold, and the uptick in Tokyo inflation supports BOJ rate hikes.

Analysts observing previous BTC bull market said the outlook remains constructive while long-term holders continue to distribute their coins.

As observed by many metrics, Monday’s capitulation in bitcoin looks like a textbook local bottom.

Bitcoin’s taban to $100,000 was quickly bought up and its outlook still remains “bright,” one analyst said.

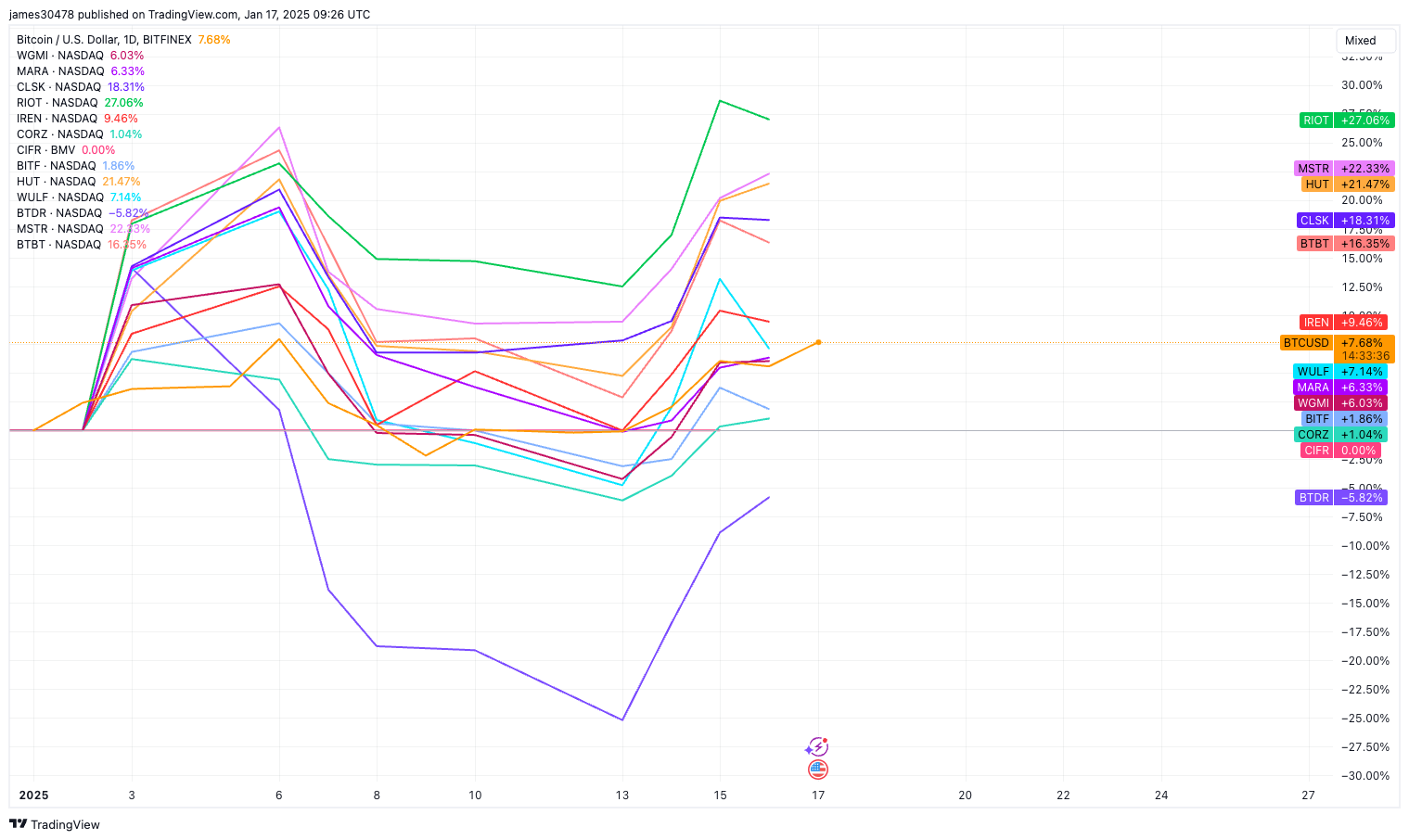

Bitcoin holdings for public U.S.-listed companies have more than doubled since January 2024.