Bitcoin

Bitdeer currently holds 855 BTC, valued at approximately $69 million.

In a worst case scenario, prices could slide to the $72,000–$74,000 range, one analyst said.

With rising energy cost, many miners may not survive the 2028 halving, MARA said.

Bitcoin’s stumble begs the question asked during the last bear market: Is there a point at which Michael Saylor would be forced to liquidate part of the company’s near-500,000 BTC stack?

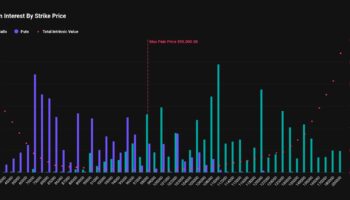

Over $5 billion of notional value is set to expire this Friday on Deribit at 08:00 UTC.

Genesis Digital Assets is a private bitcoin miner that claims to have one of the largest hashrate capacities in the world.

Many on-chain metrics show signs of capitulation and seller exhaustion in bitcoin.

GameStop has a unique opportunity to redefine itself as a market leader with its nearly $5 billion cash reserve, the letter said.

The interest rate outlook has gotten appreciably softer over the past couple of weeks.

BTC hits three-month as Nasdaq futures point to continued risk aversion in stocks and the anti-risk Japanese yen strengthens against the U.S. dollar.