Ethereum Foundation Moves $165M in ETH to Participate in DeFi

The Ethereum Foundation, the organization that oversees the development of the second-largest blockchain by market capitalization, is allocating 50,000 ether (ETH) worth around $165.3 million at the time of writing to participate in the decentralized finance (DeFi) ecosystem.

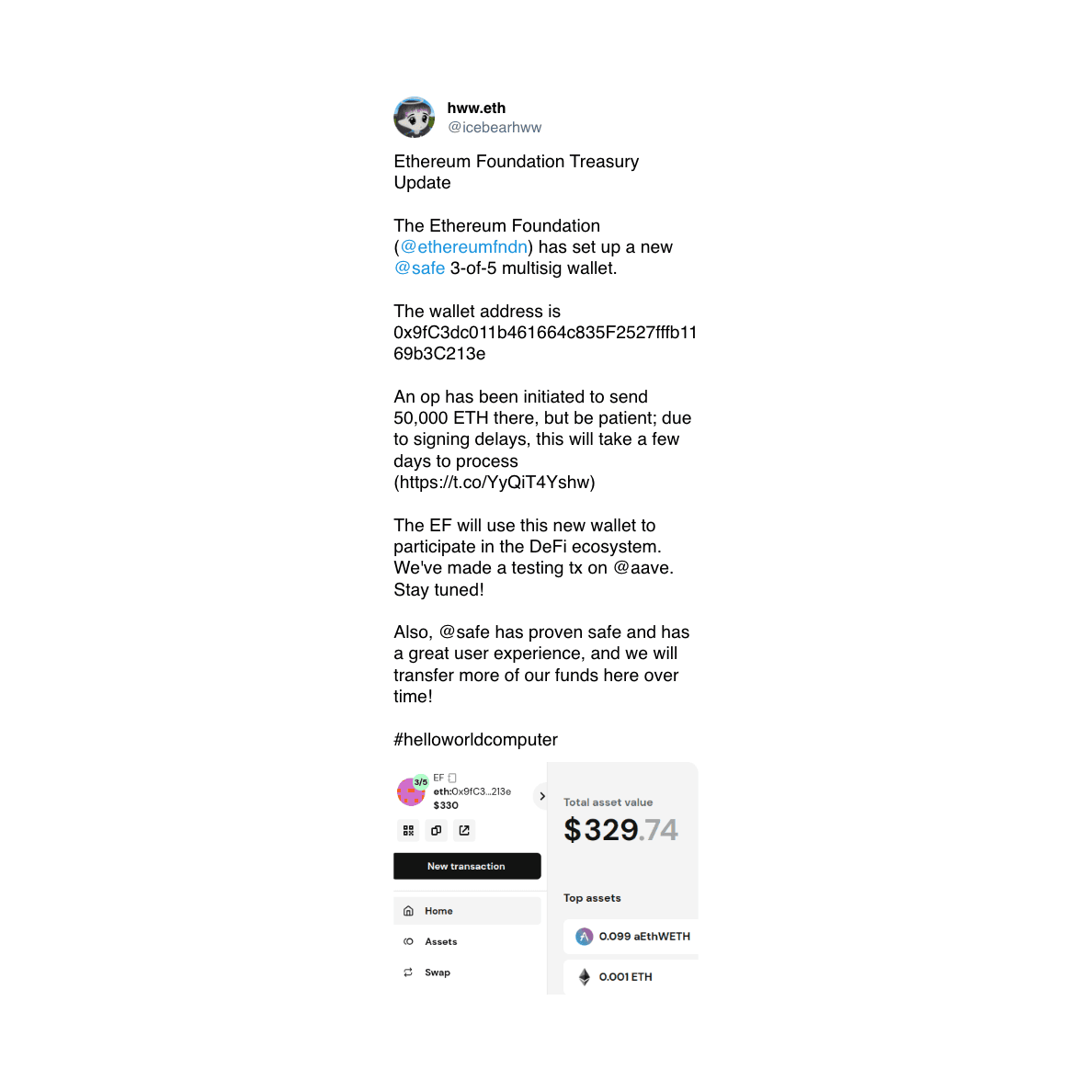

The move will see the Foundation set up a 3-of-5 multisig wallet through Safe, which the organization wrote has “proven safe and has a great user experience.” An initial test transaction has been sent to the lending protocol Aave, one of the largest in the Ethereum ecosystem behind the liquid staking protocol Lido.

Participating in the DeFi ecosystem could help the Ethereum Foundation’s treasury grow after it shrunk by 39%in less than three years to $970.2 million as of Oct. 31. The nonprofit holds the majority of its treasury in ether, which recently dropped to a four-year lowagainst bitcoin.

According to Ethereum co-founder Vitalik Buterin, the organization has so far avoided staking its ETH to generate revenue through staking rewards over regulatory and neutrality concerns. At the current CESR Composite Ether Staking Rate, it would be able to generate a 3.31% yield on its ether holdings.

Over the weekend, Vitalik Buterin confirmed that the nonprofit is undergoing major changes in its leadership structure, a process that “has been ongoing for close to a year.”

In the stated goals, Buterin noted that the move was meant to improve the technical expertise within the Ethereum Foundation’s top brass, improve communications and ties between its leadership and the Ethereum ecosystem’s actors, and more actively support app builders, among other things.

He also pointed out that the Foundation isn’t looking to “execute some kind of ideological pivot” or aggressively lobby regulator, nor is it looking to become a highly centralized organization.