BlackRock’s Spot Bitcoin ETF Tops World’s Largest Gold Fund in Inflows This Year

The price of gold has surged almost 29% this year, solidly beating the 3.8% gain in bitcoin (BTC). Even so, that’s failed to deter investors eager to add the largest cryptocurrency to their portfolios.

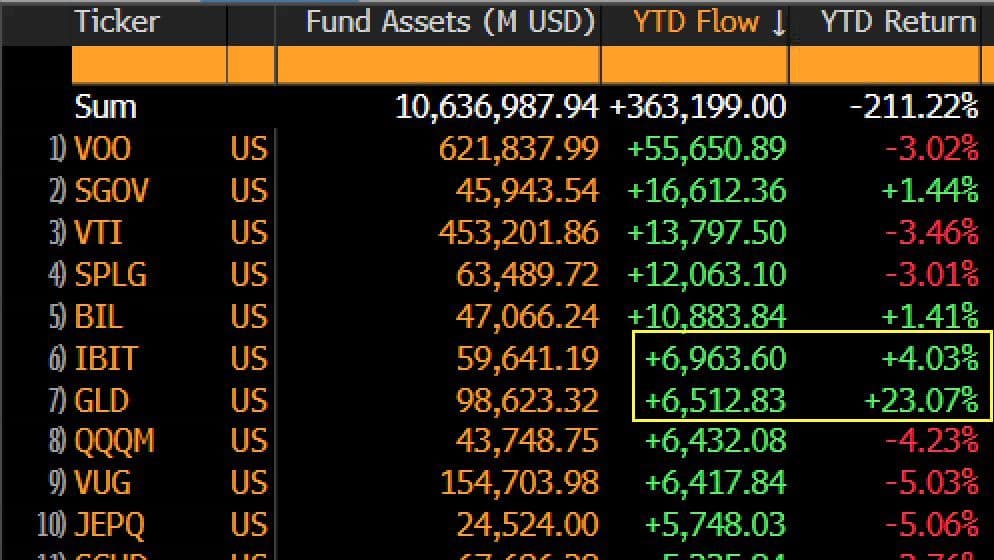

BlackRock’s spot bitcoin ETF (IBIT) has attracted a net $6.96 billion in inflows since the start of the year, the sixth-largest amount of all exchange-traded funds, according to veri from Bloomberg’s senior ETF analyst, Eric Balchunas. SPDR Gold Trust (GLD), the world’s largest physically backed gold ETF, slipped to the number seven position Monday with net inflows of $6.5 billion.

IBIT’s outperformance indicates institutions’ persistent confidence in bitcoin’s long-term prospects despite the relatively dour price performance. Gold has climbed $3,384, largely due to wrangles over international trade, renewed inflation concerns and geopolitical tensions. While BTC, called by some as digital gold, hit a record high in January, it’s now more than 10% below that level.

“To take in more cash in that scenario is really good sign for long term, and inspires confidence in our call that BTC ETFs will have triple gold’s aum in 3-5yrs,” Balchunas said on X.