Bitcoin’s Risk-Adjusted Returns Took a Hit in February

Bitcoin’s struggles in February saw its risk-adjusted returns weakening significantly according to veri from research service Ecoinometrics.

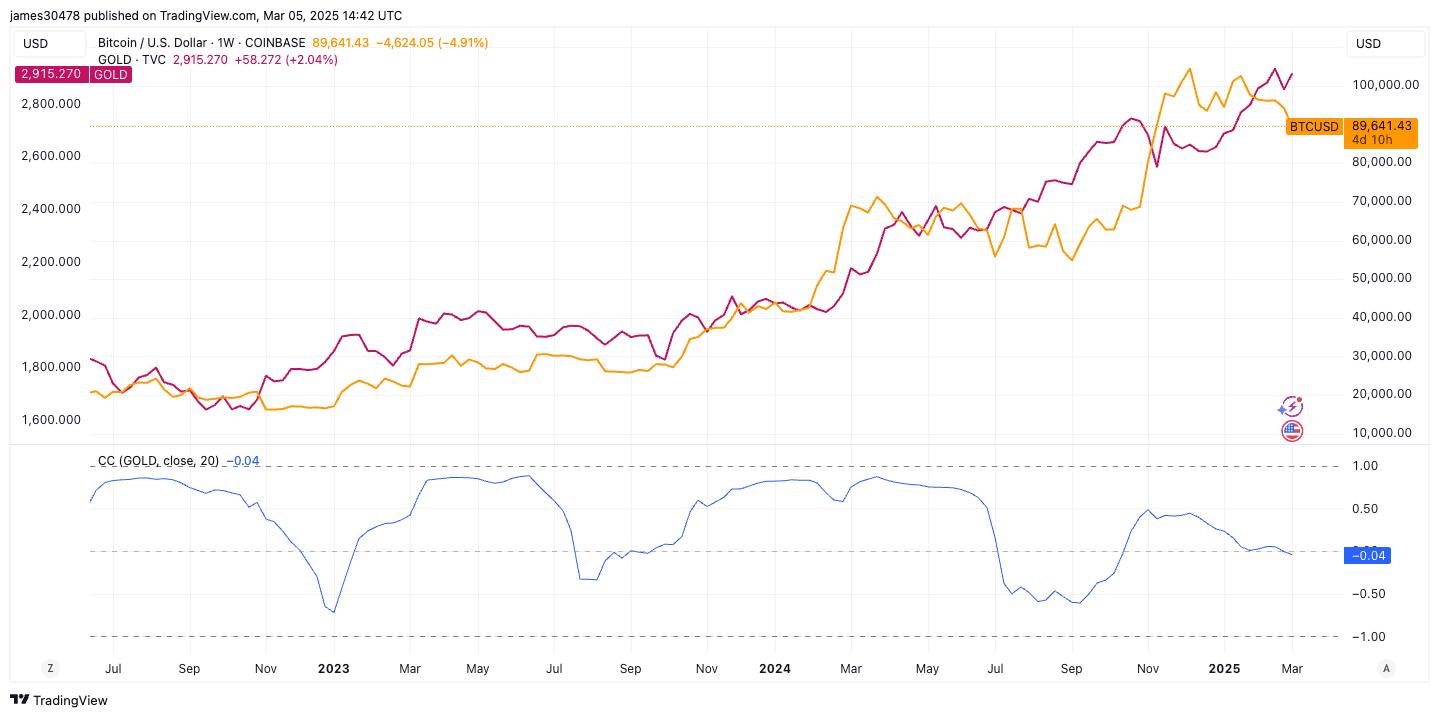

While over the past year, bitcoin’s total returns have matched those of gold, a traditional safe-haven asset, when adjusting for risk, bitcoin is behaving more like a major stock index.

https://twitter.com/ecoinometrics/status/1897259903322087697

Risk-adjusted returns measure an asset’s profitability relative to its price swings. A higher ratio suggests strong returns with lower volatility.

After a number of violent price swings of late alongside trade war threats, growing geopolitical tensions and President Trump’s sowing confusion over government plans with respect to crypto, bitcoin is modestly lower so far in 2025. Gold, meanwhile, is up more than 11% year-to-date.

“Bitcoin and gold are completely uncorrelated at the moment, on a 20-day moving average on a five year time frame it is negative,” said CoinDesk analyst James Van Straten. “You can typically see when the correlation goes negative this is usually when bitcoin is at a bottom which can be seen in early 2023, summer of 2023, summer of 2024 and now. BTC tends to catch up with gold.”

The shift could impact Bitcoin’s appeal to institutional investors, who often prioritize assets with favorable risk-reward profiles. While Bitcoin’s long-term narrative as “digital gold” remains intact, its short-term performance suggests it may be behaving more like equities than a safe-haven asset.