Bitcoin Bull Tom Lee Sees BTC Reaching as High as $250K by Year-End

The consolidation between $90,000 and $100,000 for bitcoin (BTC), continues to play with investor sentiment, swinging from fear to greed.

On Monday, bitcoin fell below $90,000, while it is above $96,500 on Tuesday, up over 8% . Bitcoin bull Tom Lee, head of research at Fundstrat, told CNBC on Monday that he sees this current correction in bitcoin as olağan.

“Bitcoin is down 15% from its highs for a volatile asset, which is a olağan correction,” he said.

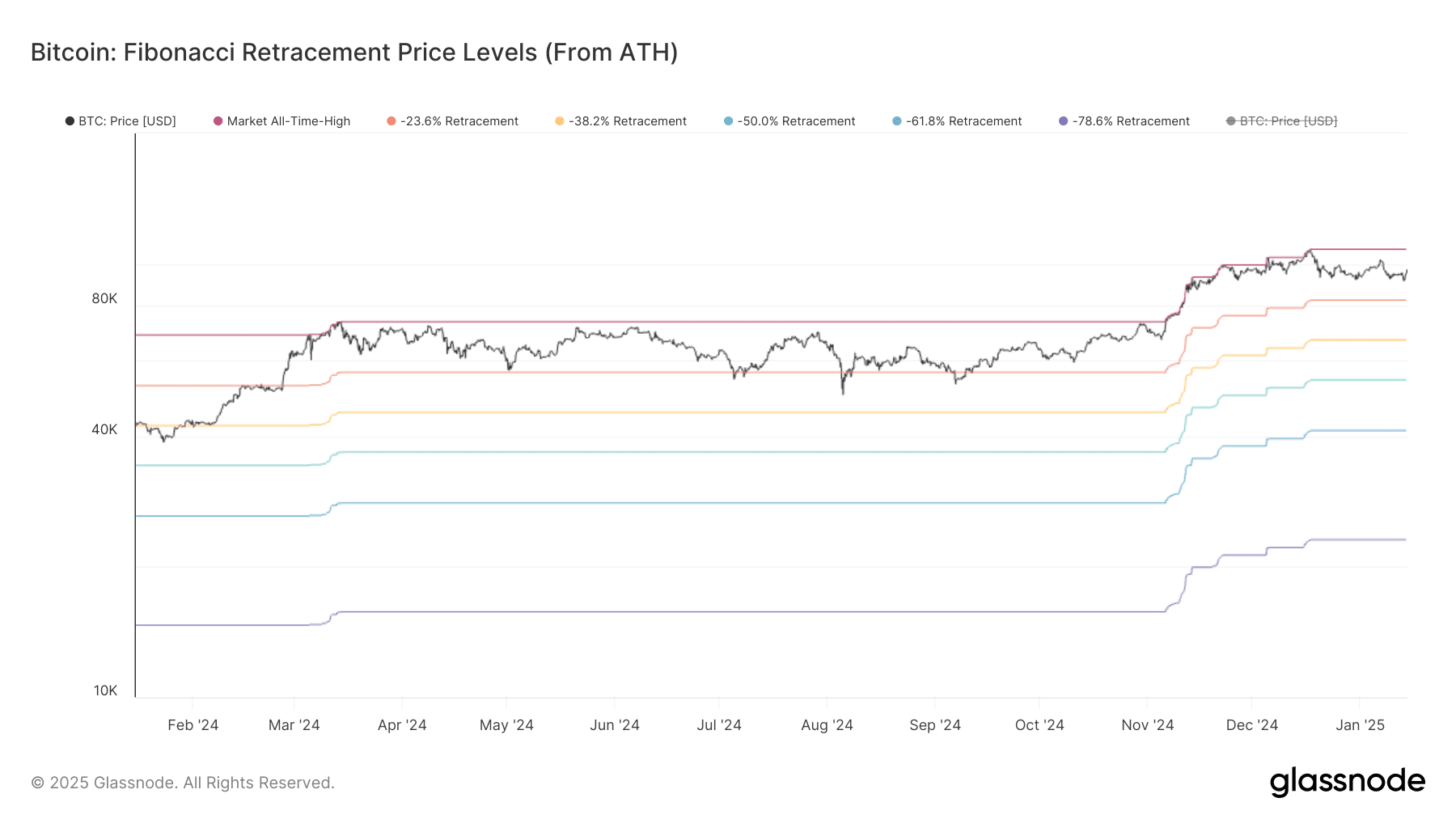

Glassnode veri shows that bitcoin in this current cycle has seen relatively mild drawdowns of around 15%-20%, much smaller than previous bull market drawdowns, which saw as much as 30%-50% drawdowns, showing the asset is becoming more mature.

According to Lee, $70,000 is a line in the sand, which is a strong support level. They refer to a methodology called Fibonacci levels, or retracement periods, essentially where bitcoin pulls back from where it started its rally. Lee also believes the $50,000 level can be tested if the prior $70,000 levels do not hold. Common Fibonacci levels from the all-time high that analysts look for are 23.6%, 38.2%, 50% and 61.8%

Despite a short-term correction, Lee still thinks bitcoin will be one of the standout assets for 2025 and remains bullish on end-of-year targets of $200,000 to $250,000.