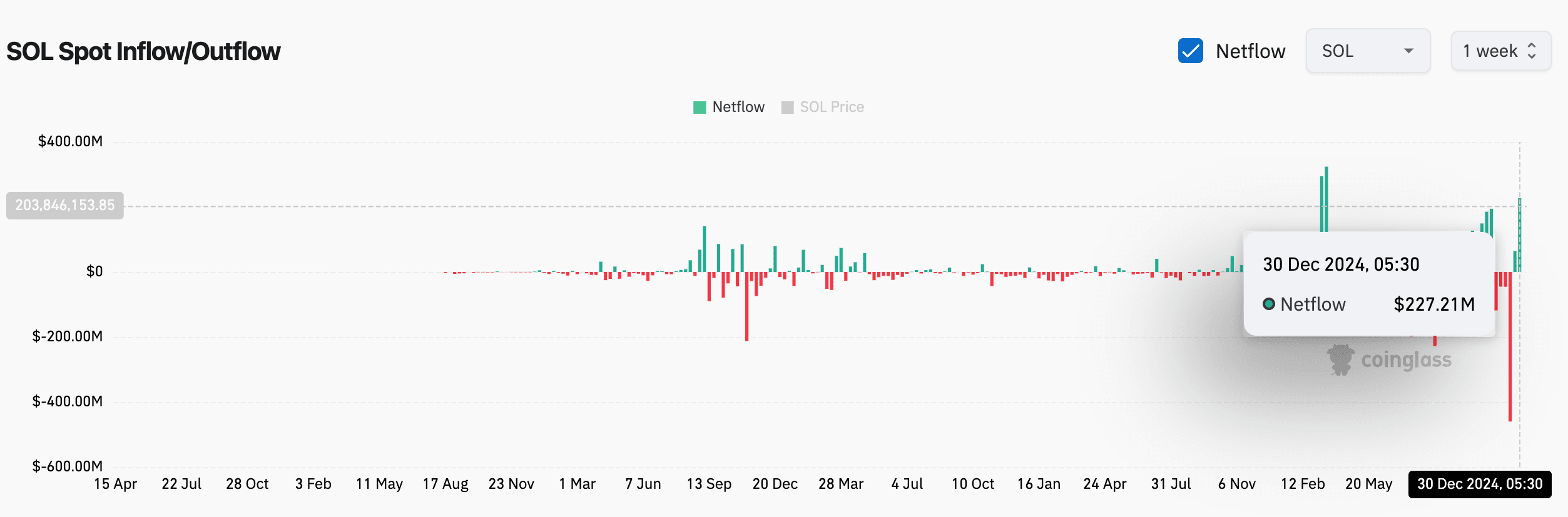

SOL Worth $227M Moved to Centralized Exchanges, Clouds Bullish Technical Outlook

A SOL market dynamic that characterized the March 2024 price top has reappeared, clouding the token’s bullish technical outlook.

Last week, centralized exchanges recorded a hefty net inflow of $227.21 million in SOL, the token powering Solana’s smart contract blockchain, marking the highest influx since the third week of March, according to Coinglass.

Back then, exchanges saw a net inflow of over $300 million in SOL. Interestingly, that moment coincided with SOL’s the-then price rally peaking near $200 and paving the way for a seven-month range play between $120 and $200.

A large movement of coins to exchanges indicates that holders may be gearing up to either sell their coins or put those at work in derivatives trading or DeFi strategies.

The latest inflow, thus, clouds the positive technical outlook that suggests prices could re-visit the November high of over $260, having recently defended key support in a bullish “throwback” pattern.

Activity in the Deribit-listed SOL options market shows a lack of bullish excitement. Per veri analytics platform Amberdata, traders have been net sellers of the upside (call options) in SOL.