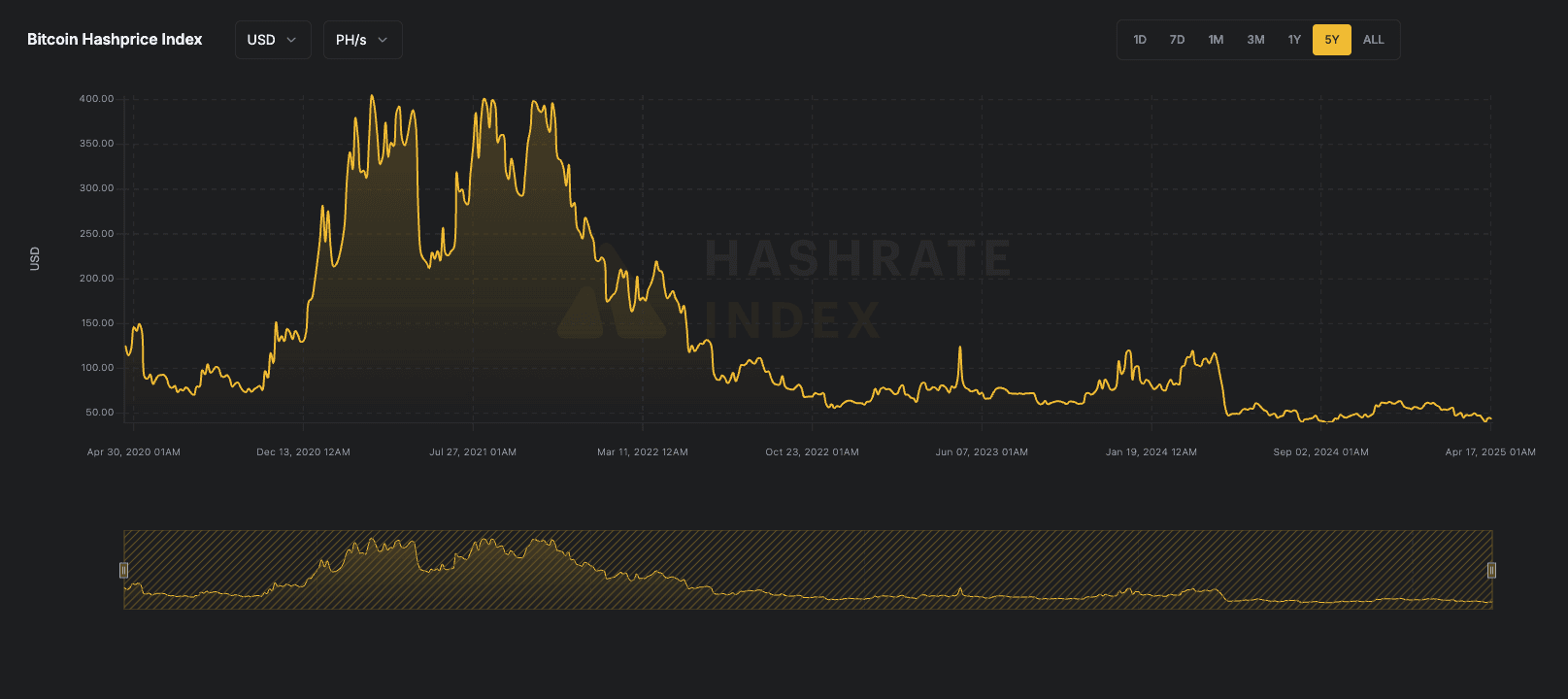

Chart of the Week: ‘Dire Picture’ for BTC Miners as Revenue Flatlines Near Record Low

Hashprice, a key metric used to gauge miner revenue, is currently hovering near a five-year low, according to HashRate Index—a stark reminder of how difficult the mining business has become.

In simple terms, the metric is the income miners can expect per unit of computing power, denoted by per petahash (PH/s). It can be denominated in U.S. dollars or BTC, although it’s most commonly quoted in USD for practical comparison.

At present, hashprice sits at $44.00 PH/s, only slightly above its August 2024 low, when bitcoin reached $49,000 amid the yen carry trade unwind. Currently, bitcoin is trading around $84,000.

Despite the higher BTC price, miner revenue is dwindling, which paints a dire picture of the mining industry as a whole after the recent halving event cut the rewards by half. Rising competition, higher mining difficulty, lower transaction revenue, and spiking energy costs have added more pressure to the revenue.

However, it’s not all bad. At around $44.00 PH/s levels, depending on what type of mining machines miners are using, miners can still be near or at breakeven, although far from 2021’s mining bull run.

Looking ahead, deteriorating market conditions, stagnant bitcoin prices, and geopolitical uncertainty, such as potential tariffs affecting mining operations, could create further headwinds for the industry.

This is reflected in the performance of the Valkyrie Bitcoin Miners ETF (WGMI), which is down 50% year-to-date while BTC fell about 10%, underscoring the challenging environment facing the mining sector.

It makes sense that miners are increasingly pivoting into other revenue streams, such as reallocating computing power for artificial intelligence.