Bitcoin Gives Up Gains as U.S. Election Anxiety Unleashes Crypto Volatility

A cryptocurrency rally saw a rapid reversal during the U.S. afternoon hours as the final stretch of the U.S. election left traders jittery.

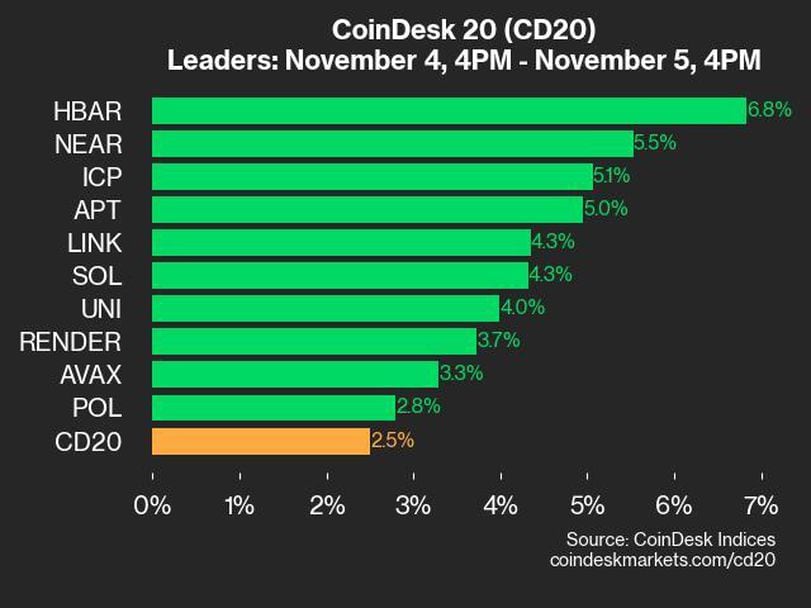

Bitcoin (BTC) surged to $70,500 earlier during the day from around $67,000, then shed 2% in an hour to briefly drop below $69,000. It was trading at $69,000 at press time, still up more than 2% over the past 24 hours.. The broad-market CoinDesk 20 Index booked 3% gain during the same period, led by native tokens of Near (NEAR), Aptos (APT) and Hedera (HBAR) advancing 6%-7%.

Ether (ETH) continued its streak of dismal performance relative to bitcoin, with the ETH/BTC ratio dropping below 0.035 for the first time since April 2021. ETH lagged with its 0.4% daily gain, while litecoin (LTC) was also flat.

The abrupt selloff happened as Trump Media & Technology Group (DJT), the company behind Truth Social social-media platform founded by Republican presidential nominee Donald Trump, plummeted 20% and was briefly halted from trading Tuesday afternoon. There wasn’t any immediately clear catalyst of the price drop, as odds for Trump winning the election dipped only slightly to 61% from 62% on blockchain-based prediction venue Polymarket. Traders perhaps took profits after DJT share prices earlier today spiked 18% from yesterday’s closing price, and are still up 178% from the September lows.

Zooming out, bitcoin is still trading within a narrow range below its all-time record heading into the U.S. election night, which is viewed as a key source of uncertainty for crypto prices.

“We expect spot [prices] to chop around this range until we get more clarity on the election results this week, where a Trump win is likely to cause a knee-jerk reaction higher, and vice versa if Kamala wins,” digital asset hedge fund QCP forecasted in a Monday market update.

The worst case scenario for risk assets including cryptocurrencies would be “a delayed or contested election – much like in the 2000 election – where the result is unknown for weeks,” said Bohan Jiang, head of OTC options trading at Abra. “This would lead to a sell-off in risk assets in the meantime, wherein the event volatility would roll to subsequent weeks until we get a resolution.”