Bitcoin Difficulty Hits New Highs as Key Metric Signals Miner Capitulation and Possible Bottom

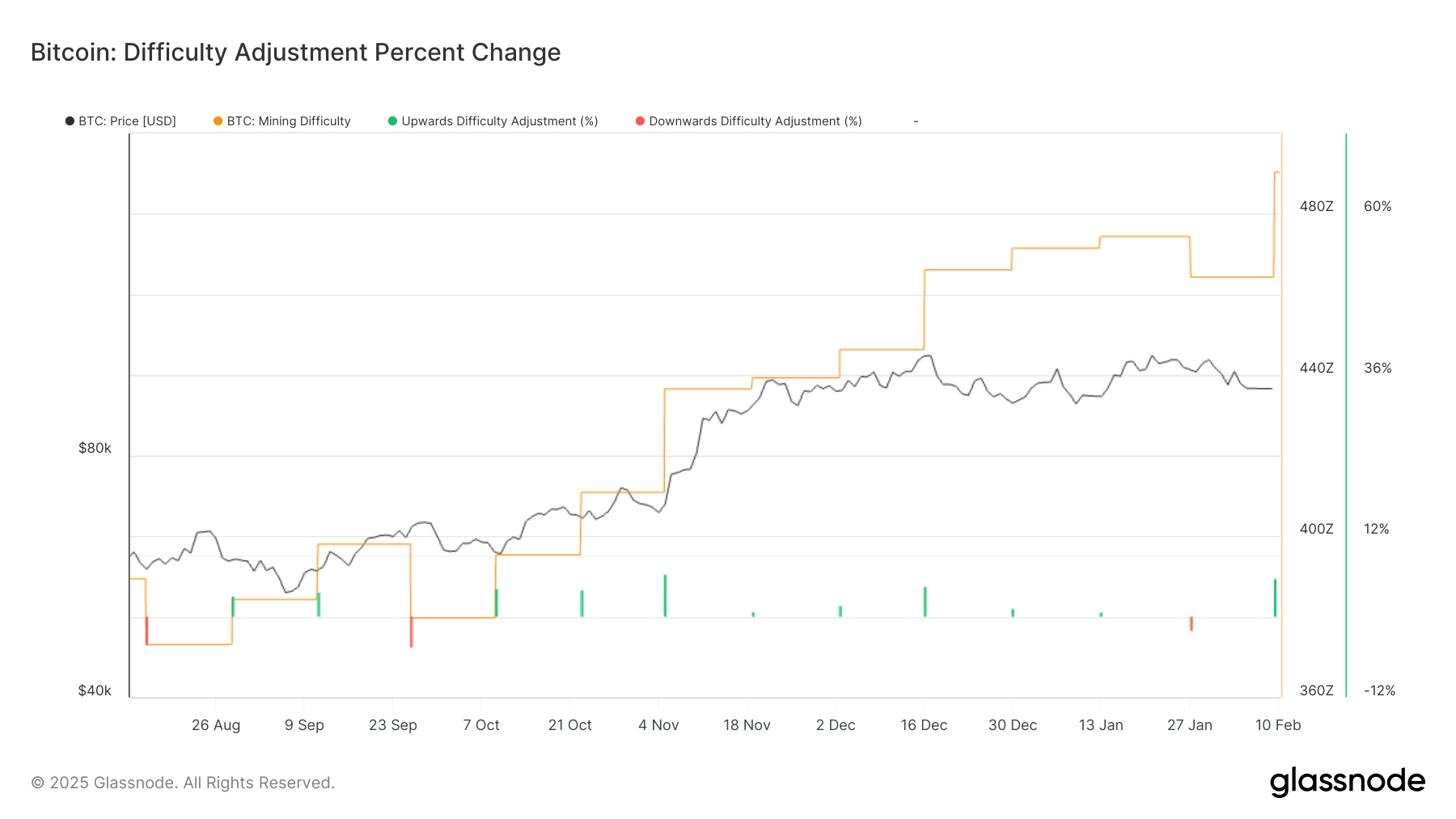

Bitcoin (BTC) difficulty hit an all-time high of 114.7 trillion (T) following a 5.6% upward adjustment over the weekend, according to CoinWarz.

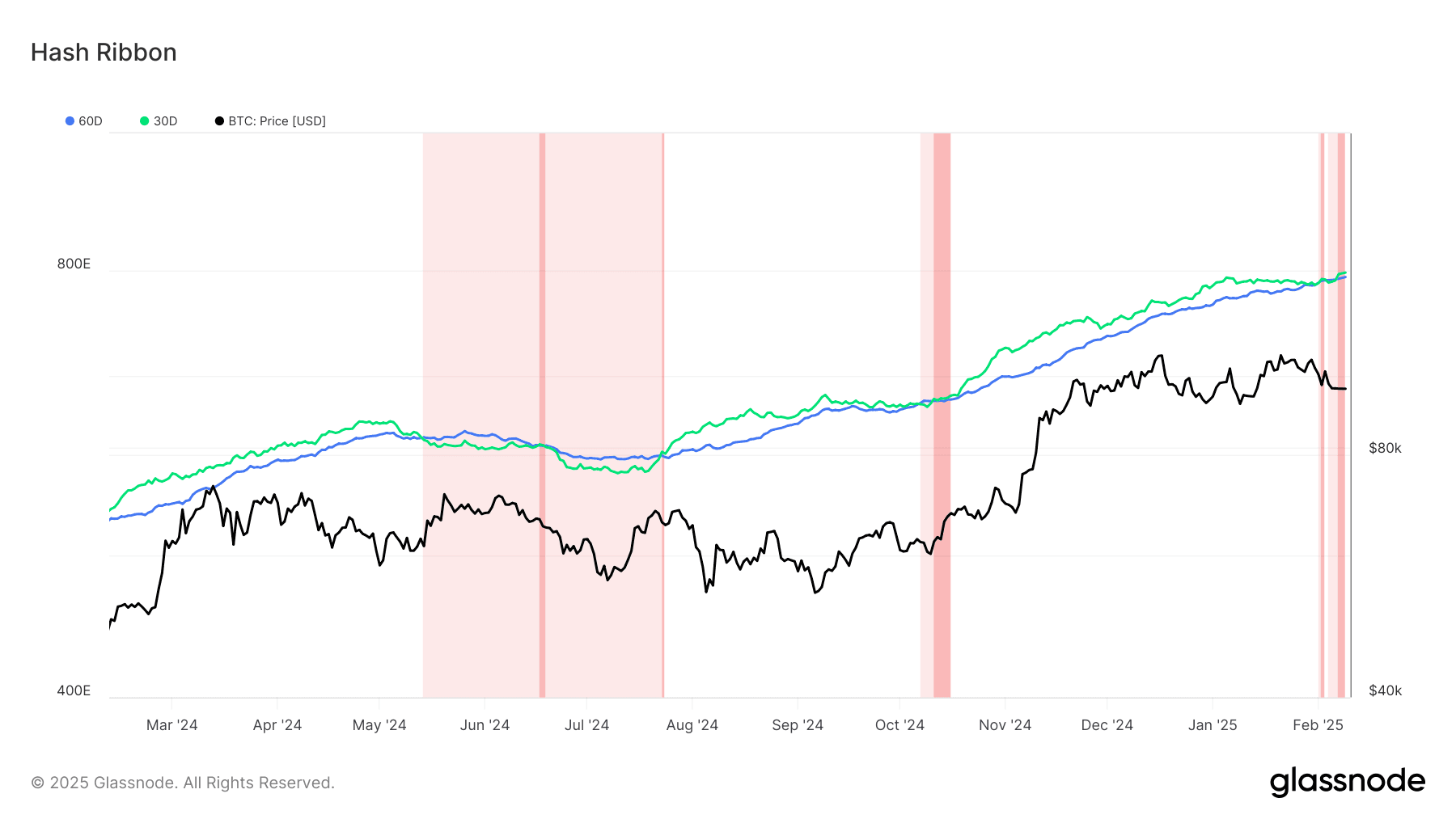

This coincides with the Hash Ribbon metric signaling a miner capitulation. Hash Ribbon, is a market indicator, which hints at a local bottom for bitcoin (BTC) and often forms when miners capitulate — when mining costs exceed profitability.

According to Glassnode veri, miner capitulation began in early February. Bitcoin is down over 4% month-to-date. Historically, when this metric signals capitulation, it has marked local price bottoms.

If this pattern holds, bitcoin’s bottom could be around $91,000. The last capitulation signal occurred in October 2024, just before BTC surged 50%.

This rise in difficulty is due to bitcoin’s rising hash rate, which hit an all-time high on Feb. 4. Mining difficulty adjusts every 2,016 blocks, targeting an average block time of 10 minutes.

As difficulty increases, mining becomes more competitive, placing additional pressure on miners. January’s production veri reflects this, with Riot Platforms (RIOT) being the only major public miner to report a month-over-month production increase.