Bitcoin’s Drop on Thursday Spurred Panic Sales Among Short-Term Holders: Van Straten

Disclaimer: The analyst who wrote this piece owns bitcoin.

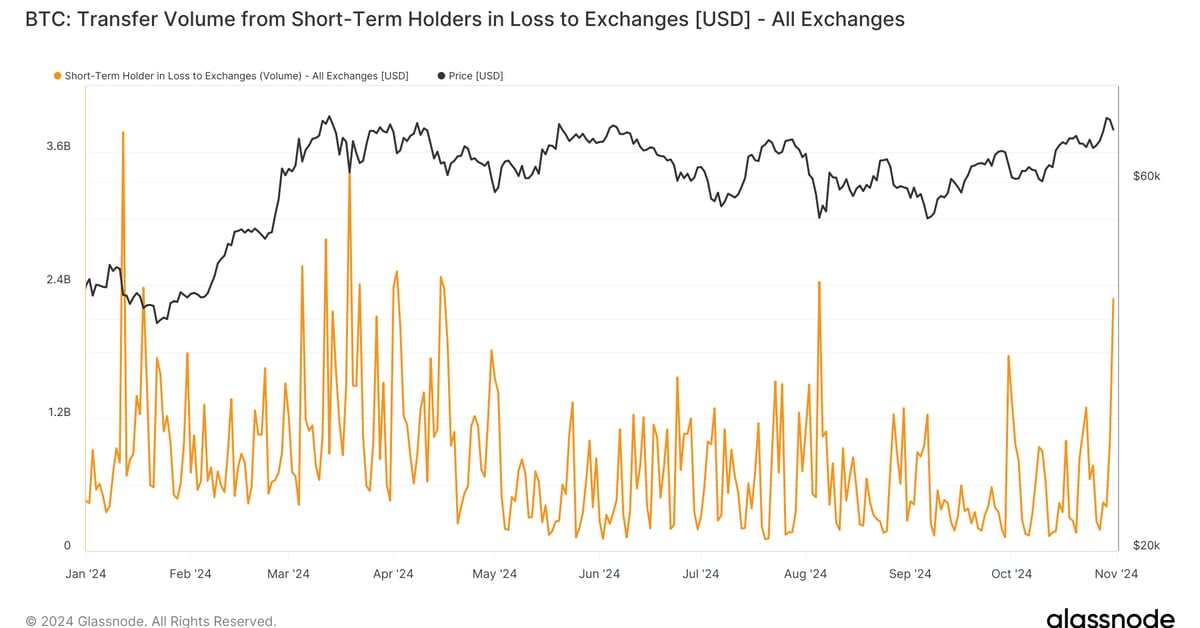

Short-term holders of bitcoin (BTC) sent about $2.3 billion, some 32,000 tokens, of the largest cryptocurrency to exchanges at a loss on Thursday as the price dropped below $70,000 after approaching an all-time high earlier in the week.

The panic selling was the most since Aug. 5’s yen carry trade unwind. Short-term holders — investors who have held bitcoin for less than 155 days — tend to panic and sell when the price drops, and buy when there is euphoria or greed in the market. In total, they sent over 54,000 BTC to exchanges on Thursday, the highest amount since Mar. 27.

A number of factors may be playing into the recent drop, which has taken BTC to about 6% below its record.

A U.S. presidential election is coming on Nov. 5, with investors most likely reducing their exposure to risk, which they tend to do on the last day of the month.

We also witnessed an almost $1 trillion wipeout of the U.S. stock market on Thursday, with every one of the so-called magnificent seven tech stocks in the red.

Breaking down Thursday’s 54,000 bitcoin into profit and loss, CoinDesk research has shown continued profit-taking as bitcoin inched closer to March’s record high. On Thursday, 22,000 BTC was sent to exchanges in profit, and over the past three days, over $6 billion of bitcoin was sent to exchanges in profit. Bitcion rose 11% last month.

Considering the 155-day timespan to be considered in this category, the investors would have most likely bought this week. Bitcoin rose above $70,000 in May and July and holders then didn’t seem phased by the subsequent 20% drawdowns, a sign they’re not likely to be shaken out by a 6% price drop.

Due to uncertainty around the U.S. election, bitcoin will likely not reach new all-time highs until after result is known.